I did this last week and found it tremendously beneficial! It gave me and my husband:

- a clear picture of our current financial position

- the ability to identify a few glaring areas needing immediate improvement

- the ability to dream and set realistic goals for 1, 5, 10 year horizons

- the ability to put a will together that lists all of our assets (In case we die, we want all of our assets to be easily discovered and go to our kids – not the state!)

The exercises didn’t take long and the benefits were significant. Going forward, I will do this at the end of each year.

We all have resources (time and money) that God gave us to steward. We need to do our best with them to yield the greatest outcomes for his Kingdom, which includes attaining financial freedom ourselves (knowing you have money available alleviates so much stress and frees your mind to be able to give to others).

Try this exercise!

I used Excel for this. You could use any spreadsheet application, or even paper and a calculator.

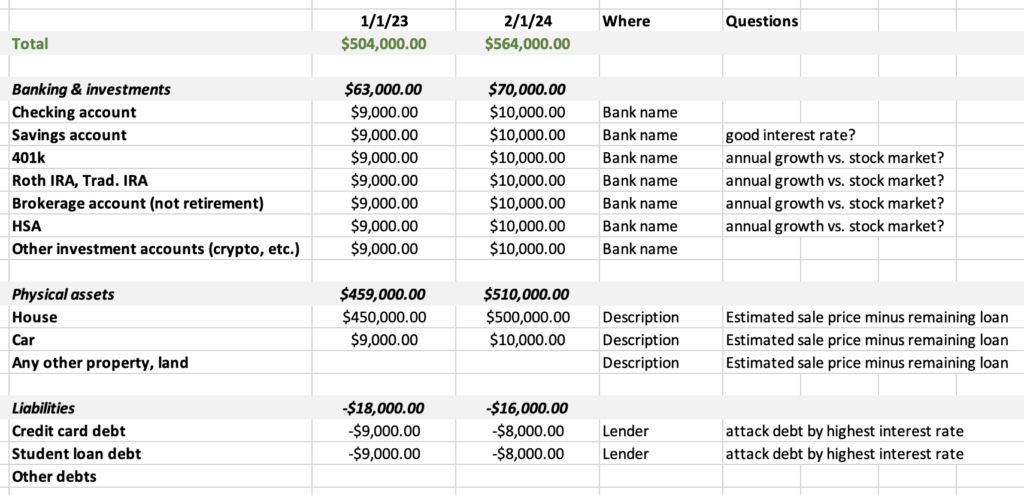

I. Calculate net worth

- Create a spreadsheet called “Family snapshot”

- Create a tab called “Net worth”

- In the left column, list every asset you own and list every liability

- Above I included a screenshot with examples.

- You may likely have a different set of accounts and assets to list. For example, maybe you have two checking accounts or two cars – just add a row for each separate asset or debt. If you have debt sitting on 2 different credit cards, list those separately.

- I grouped them, but you can organize however it makes most sense to you.

- Include the name of the bank or lender for each.

- For debts, be sure to note the interest rate and whether it’s a variable rate.

- Input current value for each

- I like to get as specific as possible.

- I add the exact value for investment accounts. Acknowledging that the value of securities is volatile (even an hour later the exact value will change) – that’s ok! It’s important to see real numbers and feel empowered by real value.

- I add an estimate for physical assets. For the house I take the low end of Redfin’s estimate. Similarly for the car I will do a quick search for a similar make/model/year for sale to get ballpark estimate.

- In my example above, I didn’t list the mortgage as a separate liability, I just included it in my value estimation of the house. For example: if Redfin estimates $700k sale price for my house but I still owe $200k on the mortgage, then I input $500k for the home value estimate.

- Add up the value of all assets and subtract the liabilities. This is your net worth!

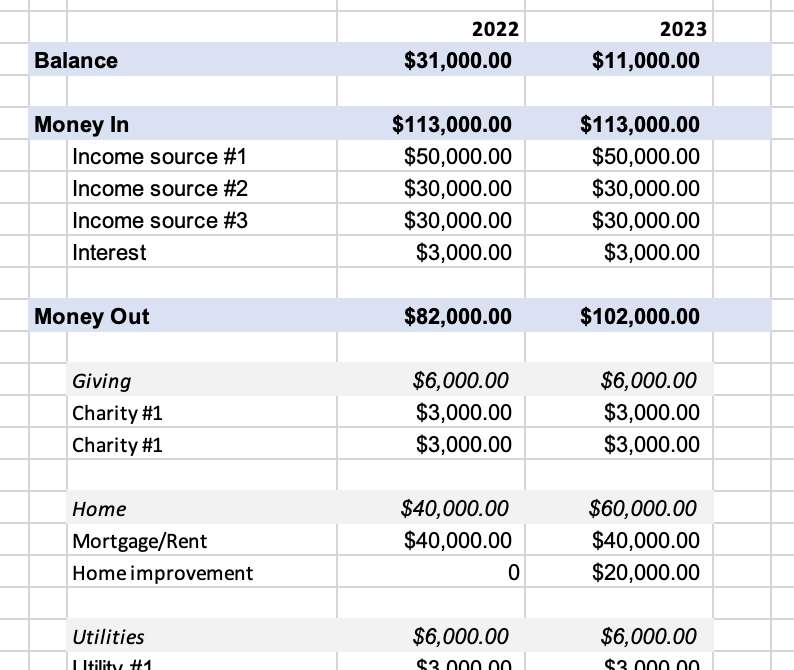

II. Money in, money out

This exercise shows how cash-in-hand was managed this year. If you use a budgeting app, you may already have this visibility.

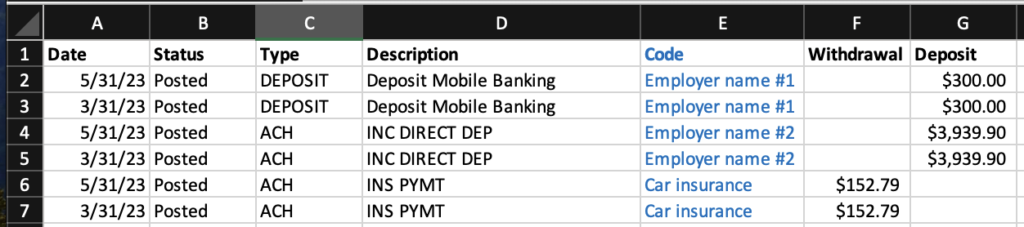

- From your bank’s website, export all transactions from the checking account for the date range of last year (e.g. 1/1/2023 – 12/31/2023) – usually they offer this in a CSV format. Open the CSV file and copy all transactions.

- In your “Family snapshot” spreadsheet, create a new tab called “Checking 2023”. Paste the transactions.

- If you have multiple checking accounts you can repeat this process for each.

- You may also want to do the same for credit card transactions – depending on how granular you want to analyze.

- Add a column called “code”. Underneath this column you will create a distinct name for each category of income or expense.

- For example, if it’s a deposit from an employer, put the employer’s name. If it’s a payment for the water bill, write “Utility water”. Use whatever names make most sense to you.

- This might seem like it will take forever, but it goes fast. Especially if you sort all transactions first by the description field. In one checking account we had ~300 transactions but many of them were from the same source with same description (e.g. same employer direct deposit or same ATM withdrawal, etc.).

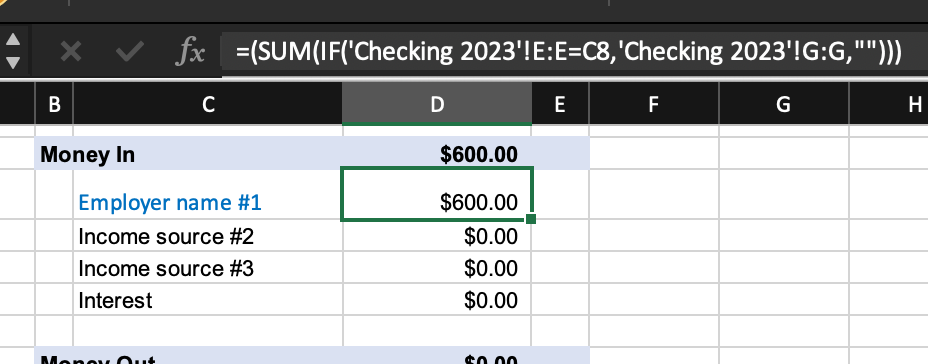

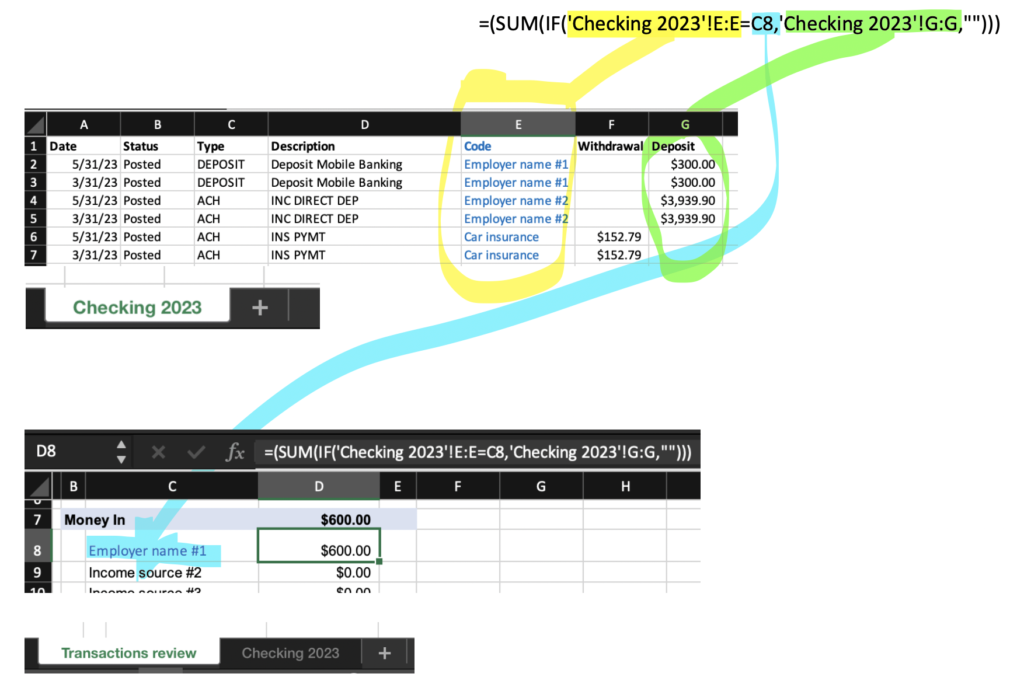

4. Create a new tab called “Transactions review”

5. In the left column, list every code that you came up with, bucketed either as “money in” category or “money out”.

6. Use a formula to automatically add up every transaction that uses each code.

This is the formula I used:

=SUM(IF(‘Checking 2023′!E:E=C8,’Checking 2023’!G:G,””))

You should adapt this to ensure it matches correctly the data format you have.

Here’s how the formula works:

- =SUM(IF(…))

- This is saying, add up the value if the conditions are met

- ‘Checking 2023’!E:E=C8,

- Look on the checking tab in the E column, for any row with the exact string written in cell C8.

- ‘Checking 2023’!G:G,

- For any exact matches, return the value of the deposit (the value in column G)

- NOTE: for expenses, return the withdrawal column instead

III. Analyze!

At least for me, this process is like looking in the mirror and realizing that I have a muffin top and spinach in my teeth, but wow this shirt is flattering. LOL. In other words, I saw a few surprises, both good and bad. How do you feel about what you see?

- Net worth – Remember, this is not your worth as a human. This is purely an analysis of your resources. Everyone will have areas to improve. If you don’t know what you have, you can’t manage it! Ideally you will see this number improve each successive year.

- Checking & savings – What interest rate are you getting? At the current time of writing (Feb 2024), it is possible to get ~5% interest rate for storing cash. If you’re not getting this it could be time to shop around. Search for “high yield savings” or “money market account” (not money market fund or CD).

- Investment accounts – What kind of return did you get this year? Did you do same or better than the overall stock market? If not it may be time to reconsider which investment products you own. I’m a fan of total stock market index funds (examples on Forbes). They have low fees and are self-diversified.

- Debts – Ensure you know which ones are most expensive (highest interest rate, and/or risky with variable rate) and swarm to pay them off first. Time is of the essence with debts. The faster you pay it off, the more total money you save.

- Money in, money out – do any of the expenses feel high to you? When I did this exercise I couldn’t believe how much money we spent on water last year. I find myself now really sensitive to water use and even looking at ways to collect rainwater for the garden! When we realize an emotional connection, our behavior changes.

IV. Set financial goals

- What net worth do you need to achieve financial independence? Set a goal to hit that number. Even better, try to estimate a realistic date to hit that number.

- Try this calculator: FIREcalc. The site is a little clunky visually but the data seems good. If you did the above exercises, you could easily input how much annual spend you’d use and also how big your current portfolio. You can fiddle around to get a “FIRE” number – i.e. how large of portfolio you need to sustain you for life without working (although you may want to continue working anyways!).

- Do you have any current debts – would be a great goal to pay those off ASAP! Set a date by which you will aim to pay it off.

- Are you getting positive returns on your investment accounts? This is another great goal to try and hit minimum 7% return, which may require selling off some positions and/or buying new ones. Selling can have tax implications so be sure to work with a CPA if you have questions.

- Are you incrementally adding to your investment accounts? If not, this could be a great goal to set up a rhythm and plan for building your portfolio.

- As mentioned above, are you getting minimum 4% interest rate on your cash? If not, set a goal to find a safe place to store that cash and get good interest rate (high yield savings or money market account).

- Are you spending too much on entertainment, restaurants, etc? Are you giving enough? Set spending goals to improve your use of resources.

- Do you have children or grandchildren? Set a goal to set up an account for them – the IRS allows for some tax-free giving (be sure to check for annual & lifetime limits).

Conclusion

How did it go? Do you have any other financial practices that work well for you? Any great ideas financial goals? Success stories? Tell us in the comments!

Disclaimer: Nothing provided on this site should be interpreted as personal investment advice. Please work with a qualified investment advisor.

Leave a Reply